Invest In Canada

Real Estate Growth In Canada

Residential sector in the 5 years. Commercial and Retail Growth

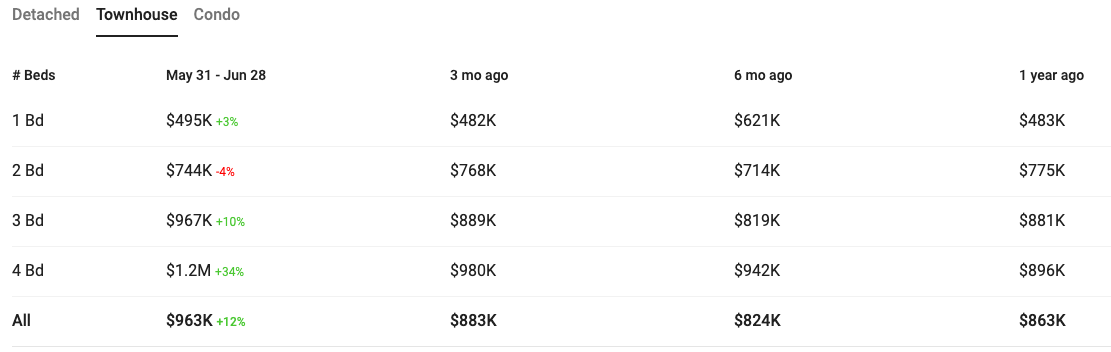

The prices for the residential sectors in Toronto and around GTA have been growing by a steady 2.5% every year. Town houses tend to rise by 3.06% while condos and apartment buildings rose by 4.85%. Commercial and Retail sector have fallen by 0.3% but are expected to rise by 2020.

Real Estate Market Predictability

Home prices and residential market is expected to grow by 3.3%

Everyone around the world is trying to invest in Real Estate as that is the single most stable form of investment. Investing in Real Estate helps generate profit over a long period of time due to the fact one can rent out the vicinity, helping pay off the mortgage while at the same time generating a second source of income.

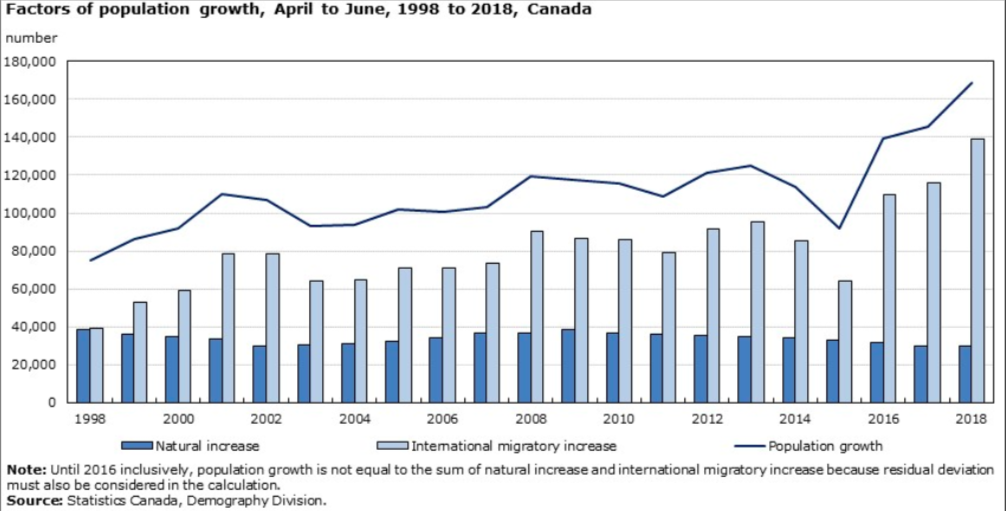

Families across the world are immigrating to Canada and some need either a vacation home where they can live and stay when they come to visit, and other may be living abroad at the moment but look to settle in Canada when they retire. Members of these demographic are also looking to invest in Real Estate, not for the purpose of flipping and making a profit, but more in the interest of actually utilizing the property and living there. Furthermore, these people tend to settle down and expand their family who would likely invest in real estate in the upcoming future as well

Mortgage Delinquency in Canada

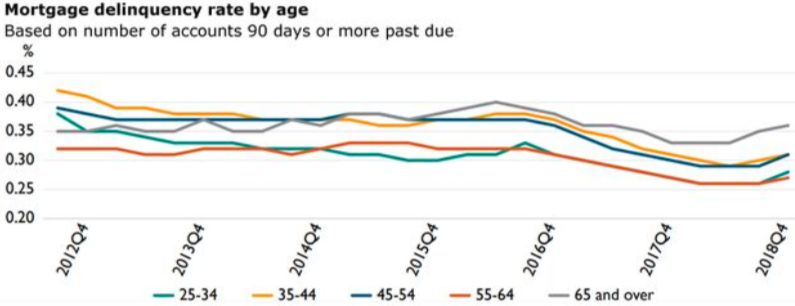

“Across all age groups, the national delinquency rate on debt excluding mortgages rose to 1.07 percent, an increase of 0.4 percent compared with the same quarter a year earlier, Equifax Canada said in a report Tuesday. The rate fell or was flat in the youngest age groups, those between 18 and 55, while it increased for those older than 56.

Bill Johnston, vice president of data and analytics, said the marginal increase in the national delinquency rate is masking underlying weakness in the country’s credit markets. He pointed to the third straight year-over-year increase in late payments for seniors, as well a trend of late payments in auto loans and leases.

The delinquency rate is up from the previous quarter’s 1.05 percent, which was the lowest since at least 2013, the data show. The rate had been declining on a year-over-year basis since the end of 2016.”

Families across the world are immigrating to Canada and some need either a vacation home where they can live and stay when they come to visit, and other may be living abroad at the moment but look to settle in Canada when they retire. Members of these demographic are also looking to invest in Real Estate, not for the purpose of flipping and making a profit, but more in the interest of actually utilizing the property and living there. Furthermore, these people tend to settle down and expand their family who would likely invest in real estate in the upcoming future as well

Immigration Trends and New Comer Home buying in Canada

Currently, there are approximately 300,000 immigrants coming into Canada ever year. This number is set to increase even further to 350,000 by the year 2021. A lot of these immigrants are coming from rich backgrounds are all looking to buy a house and settle down once they arrive. Even the ones that are not looking to buy a house are looking to rent a place to live and thus it makes more sense to invest in the real estate market right now to capitalize on future business prospects

Apart from simply immigrants coming, there are a lot of refugees who are coming from Syria and other countries of war zones who need housing and they tend to gather 2 or 3 families and split the house among themselves. With modern townhouses and detached houses having a basement with multiple rooms in them, one can easily rent out the basement and double the income coming in.

Investment Security in Canada

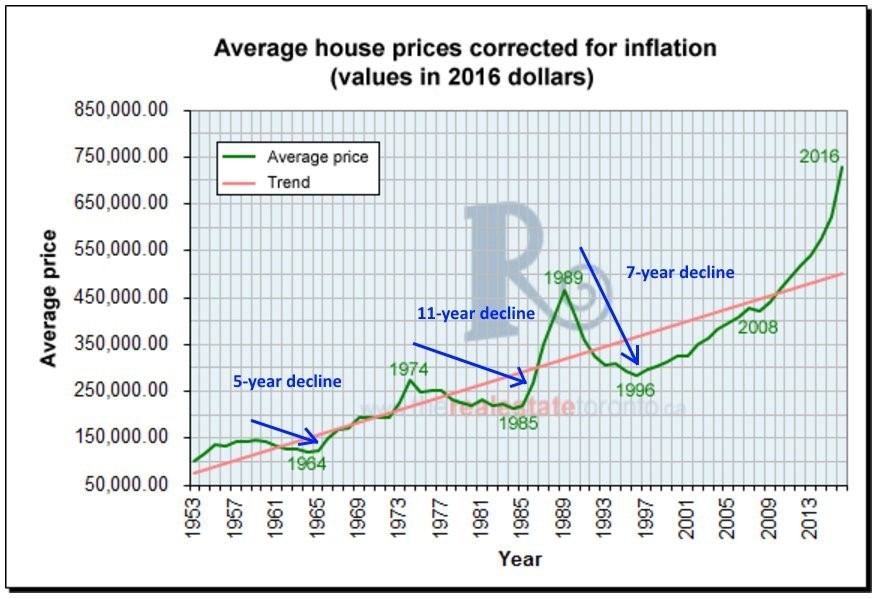

There are a large number of investment securities in Canada, from investing in Stocks, Bonds to Real Estate. The safest security has always been real estate as the chances of it crashing are very low. Unlike buying bonds in a company, the company can always fail or may not do as well, however with real estate, even if the price falls, it does tend to rise back up in a small period of time.

People have been investing in Real Estate for a long period of time as not only is your money kept in a safe place, but furthermore, you can even rent it out and gain a significant profit on a monthly basis.

Canadian Real Estate as Best Investment Opportunity

The Canadian Real Estate Market is one of the safest markets to invest into due to the ever growing population rate and density. With over 8 universities and multiple tourist attractions, people move in to the GTA and Canada at a high rate and are always looking to rent out the property. One major target segment are the students who are looking for housing during their 4 year stay for their program. On Average, the price to rent a single Room is $900 for a single month in the Core of Toronto where students go to either University or College. Such high turnover, high density locations are guaranteed to always be in demand, thus increasing the value of the investment on a large scale.

Toronto Condo Prices Rise Over 6%

The price of a typical condo apartment reached a new all-time high, according to the board’s “benchmark.” TREB reported a condo benchmark of $528,900 in April, up 6.81% from last year. The City of Toronto reached $561,500, up 7.3% from last year. Both are record highs for the region.The median sale price of condo apartments made a substantial climb. TREB reported a median sale price of $525,000 in April, up 7.14% from last year. The City of Toronto benchmark reached $562,000, up 6.03% from last year. Unlike detached homes, the median sale price reflects the trend observed in benchmark.

“The number of homes sold in Toronto climbed in April even as prices inched higher, signalling that homebuyers continue to compete for listings in an increasingly tightening housing market.There were 9,042 residential transactions in April, jumping 16.8 per cent from 7,744 sales during the same time last year, according to the Toronto Real Estate Board. Meanwhile, average home prices across the GTA rose year-over-year in April relative to the first three months of 2019.The MLS home price index showed the benchmark price ticked upwards by 3.2 per cent — the highest rate of growth in more than a year. The average sale price of a Toronto home increased by 1.9 per cent to $820,148 from $804,926, the strongest annual rate of growth so far in 2019.The hike in prices was driven primarily by higher-density segments, such as condos and lowrise apartments. The average price of a condo rose 5.1 per cent year-over-year to $588,168.